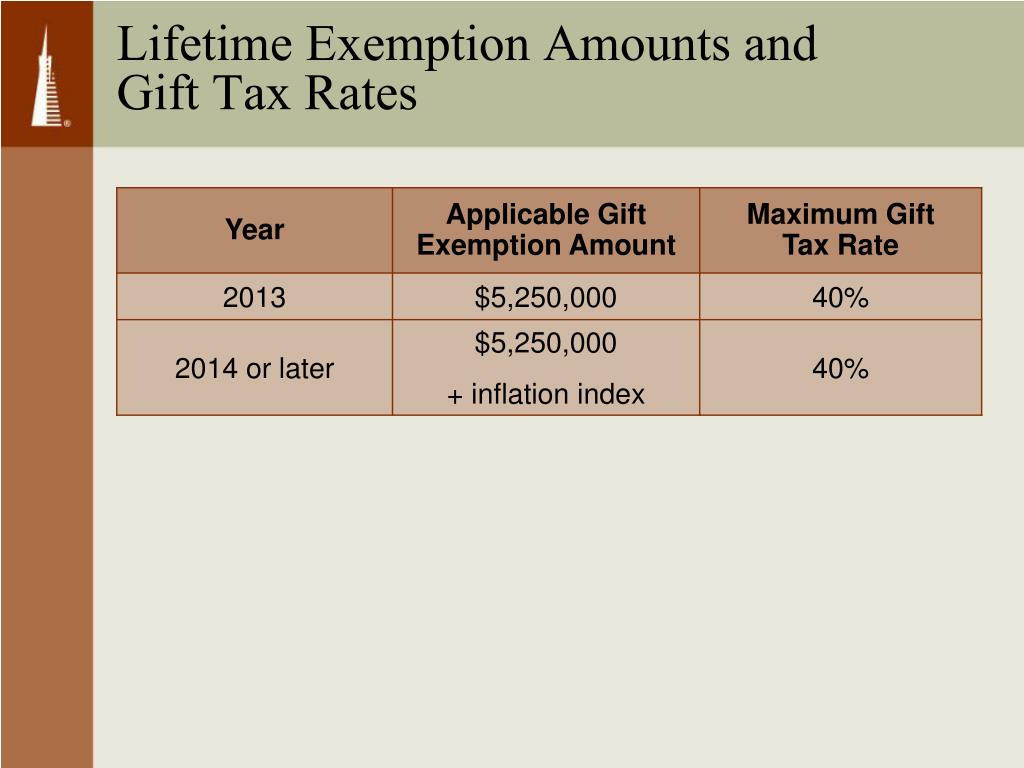

Lifetime Estate Gift Tax Exclusion 2024. This threshold doubled from $5 million to $10 million per. If you have a large estate, consider gifting during your lifetime to help reduce estate taxes.

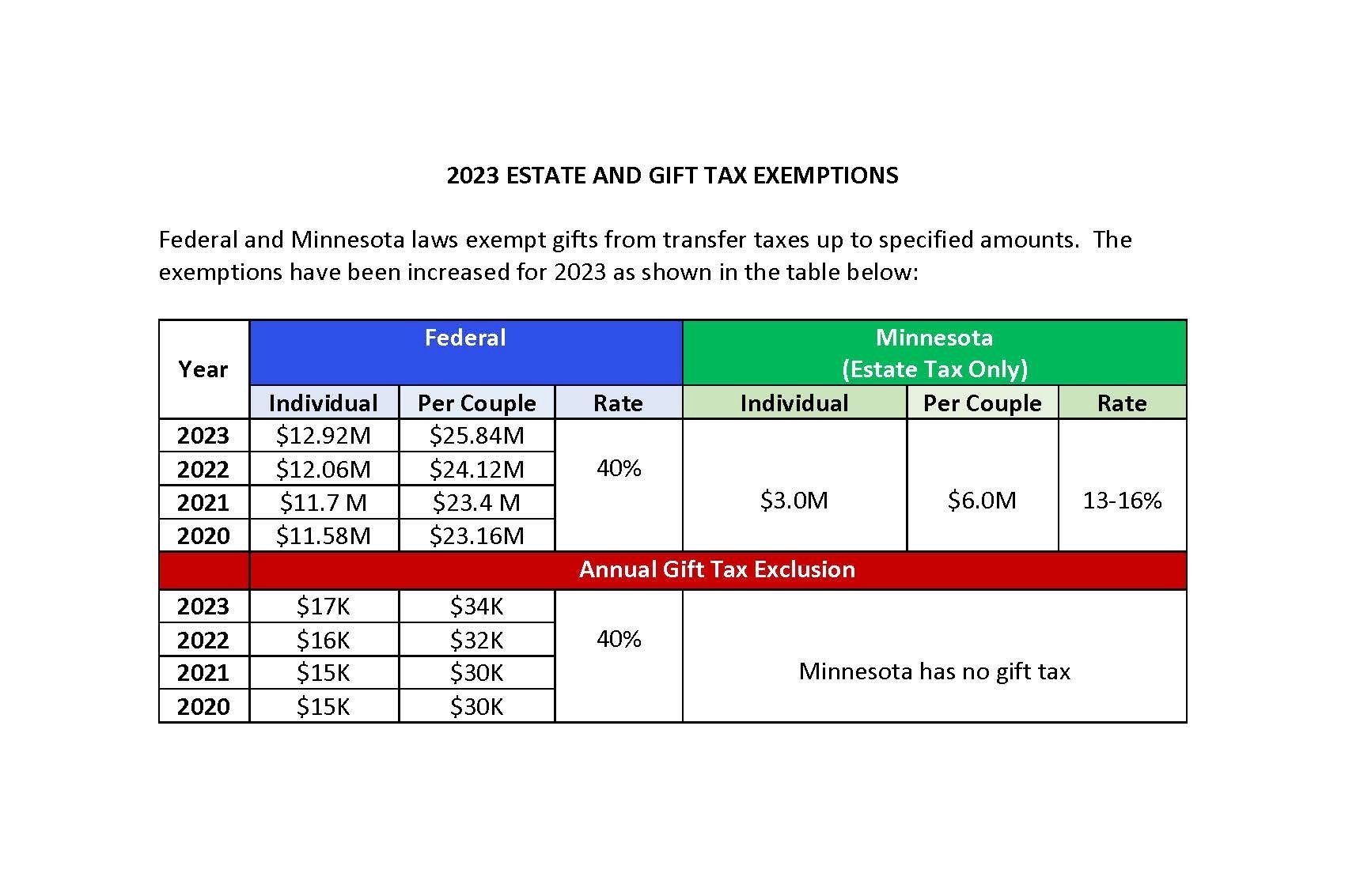

For 2024, the annual gift tax limit is $18,000. If you have a large estate, consider gifting during your lifetime to help reduce estate taxes.

If You Have A Large Estate, Consider Gifting During Your Lifetime To Help Reduce Estate Taxes.

Gift tax exemption for 2024.

The Annual Exclusion Applies To Gifts Of $18,000 To Each Donee Or Recipient Per Calendar Year.

The tax cuts and jobs act delivered a sizable increase in the tax exemption limit for estates and lifetime gifts — up to $13.61 million per person in 2024.

Lifetime Estate Gift Tax Exclusion 2024 Images References :

Source: wendiewjasmin.pages.dev

Source: wendiewjasmin.pages.dev

Lifetime Gift Tax Exclusion 2024 Limit Lulu Sisely, The 2024 gift tax limit is $18,000, up from $17,000 in 2023. These gifts can include cash as well as other types of.

Source: oliaqjuanita.pages.dev

Source: oliaqjuanita.pages.dev

Lifetime Gift Tax Exclusion 2024 Rona Vonnie, The irs has increased the estate tax and lifetime gift tax exclusions offering an opportunity to preserve wealth for generations. The combined gift and estate tax exemption will be $13.61 million per individual for lifetime gifts made in 2024.

Source: imagetou.com

Source: imagetou.com

Annual Gifting For 2024 Image to u, For 2024, the annual gift tax limit is $18,000. In 2024, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

Lifetime Estate And Gift Tax Exemption 2024 Nancy Valerie, That’s because in addition to the $18,000 annual exclusion, there is a $13.16 million lifetime exclusion, per person, for gift and estate taxes as of 2024. If a gift exceeds the $18,000 limit for 2024, that does not automatically trigger the gift tax.

Source: mashaqjulina.pages.dev

Source: mashaqjulina.pages.dev

2024 Estate Tax Exemption Irs Andra Blanche, However, this opportunity could go. In 2024, the irs expanded the lifetime gift and estate tax exemption to $13.61 million for individuals and $27.22 million for married couples.

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

Lifetime Estate And Gift Tax Exemption 2024 Nancy Valerie, Starting on january 1, 2024, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023). The 2024 gift tax limit is $18,000, up from $17,000 in 2023.

Source: emeraqbridgette.pages.dev

Source: emeraqbridgette.pages.dev

2024 Gift Tax Exclusion Amount Ebba Neille, For 2024, the annual gift tax limit is $18,000. The irs has increased the estate tax and lifetime gift tax exclusions offering an opportunity to preserve wealth for generations.

.jpg) Source: marloqleticia.pages.dev

Source: marloqleticia.pages.dev

Gift Lifetime Exemption 2024 Ertha Jacquie, The federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person and $27.22 million per married couple next year. Individual taxpayers may also make gifts up to $18,000 per gift recipient (up to $36,000 per recipient for married couples) in 2024 without using any of their lifetime estate and.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The gift tax is a federal tax on transfers of money or property to other people who are getting nothing or less than full value in return. The annual federal gift tax.

Source: www.carboncollective.co

Source: www.carboncollective.co

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, Spouses can elect to “split” gifts,. A married couple filing jointly can double this amount and gift individuals.

The Gift Tax Annual Exclusion Allows Taxpayers To Make Certain Gifts Without Eroding The Taxpayer’s Lifetime Exemption Amount.

With portability or a bypass trust, spouses can combine their.

Also For 2024, The Irs Allows A Person To Give Away Up To $13.61 Million In Assets Or Property.

Explore annual gift tax exclusion and lifetime exemptions.

Posted in 2024